Making A Claim

Income safety insurance coverage is more for short-term accidents or sickness. Superannuation insurance coverage policies in NSW may cover Income protection claim lawyer claims similar to total and permanent incapacity, earnings protection, trauma insurance coverage, and terminal illness claims. Yes, revenue safety held inside super are tax-deductible to the fund, but you’ll not receive this tax deduction. However, in case you have income safety outside of tremendous, the premiums are generally tax-deductible to you.

Brochures And Varieties

We have entry to one of many largest and most experienced groups of rehab professionals in Australia. Our rehabilitation group works with you, your worker and relevant rehab program suppliers to find the greatest way to assist your employee’s return to well being. Their benefit will be tax free regardless of how their employment ceases. Your employee simply needs to complete the Withdrawing your tremendous kind and ship it to for processing. If we problem an IRC, this will provide confirmation that your worker meets the definition of being permanently incapacitated and is ready to entry their tremendous benefits.

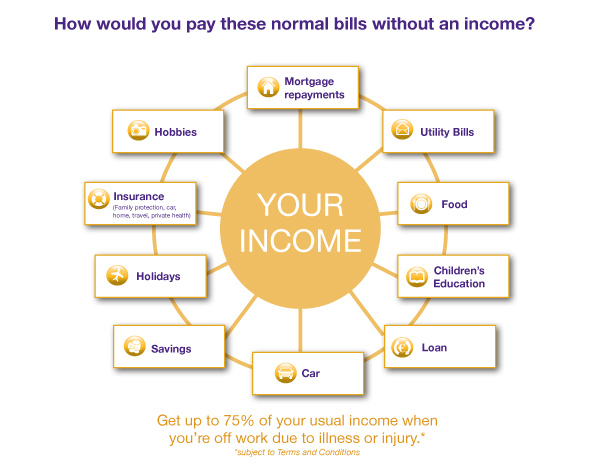

“Offsetting in opposition to different revenue safety policies is fairly common,” says Kelly. “It’s most unlikely you’re going to get greater than 75% of your pre-disability revenue.”

There are some trade funds which have automatic earnings safety insurance coverage upon sign-up but these are restricted. Most individuals in Tasmania with superannuation could have TPD insurance coverage and perhaps additionally revenue protection insurance coverage. Unfortunately, the claims course of can usually be difficult and stressful, particularly when you are struggling with harm or illness. A small error or missed element can lead to your claim being delayed or denied. If you’re unable to work due to illness or harm, you might be eligible to claim in your earnings loss under your revenue protection insurance coverage coverage. A third disadvantage to purchasing insurance coverage through superannuation is that the members of the SMSF could not all the time have complete control over the choice of their beneficiaries.

From college charges to mortgage, from journey expenses to groceries – insurance coverage for income protection SMSF out of your self-managed fund is a ray of hope within the event of sudden accidents or serious illness. The paperwork wanted for a super insurance claim typically embody medical records, proof of employment, superannuation statements, and some other related documentation required by your tremendous fund. To start a super insurance coverage declare with a lawyer, contact a superannuation insurance declare lawyer, provide particulars of your situation, and submit the mandatory documentation.

How Does Earnings Safety Insurance Coverage Work?

If you had been injured at (or as a result of of) work, you’re entitled to workers compensation and revenue safety. While you’ll find a way to legally declare both on the same time, it’s not all the time advisable—it all depends on your individual circumstance. Remember, the claims process can vary relying in your insurance provider and coverage.

The level of income protection SMSF cowl you’ll have the ability to achieve by way of your SMSF can also be limited. TPD insurance provides financial help should you can no longer work as a result of a disability, harm, or illness. If you’ve determined to take out standalone cover, you can take away revenue safety out of your superannuation. Go to your super fund’s website, log into your member’s portal and observe the prompts.

If the plan’s insurer is AIA, you might be eligible to lodge your claim via the AIA eClaims portal. The AIA eClaims portal allows you to entry, complete, and lodge insurer types online. If the insurer denies your TPD or income safety claim or solely partly accepts it and also you wish to dispute the choice, we can help. Individuals who are foreign residents for tax purposes can nonetheless get income safety insurance in Australia and are subject to different tax charges.

If you’re struck with an illness or harm that prevents you from working in your present place or one other suitable place, you could be eligible to make a TPD claim. If your TPD or revenue safety claim is denied or only partly accepted by the insurer and you need to dispute their choice, contact us. WEALTH SMART’S PRIVATE CLIENT SOLUTIONS To have complete peace of thoughts, purchasers ought to be in a position to take control of their personalised financial planning. This management is significant as no matter how certified a monetary advisor could additionally be, the shopper is conscious of their monetary needs.

The profit is calculated on both your precise pre-disability income or your sum insured, whichever is the lesser of the 2. Cbus Super acknowledges the Traditional Custodians throughout Australia and their connections to land, sea, and group. We pay respect to their Elders previous and current and prolong that respect to all Aboriginal and Torres Strait Islander peoples.

Our revenue protection solicitors are specialists at reviewing your coverage to determine every little thing you’re eligible to claim. Let us lodge your declare on your behalf so you may be assured that every one the types are lodged appropriately, maximising your entitlements. Income safety can fall beneath your superannuation insurance coverage or be held as a separate coverage. Sometimes, people are unaware or have forgotten that they even have this sort of cowl.

In some cases, the insurer may request you evaluation the information provided to assess the declare. When you’ve every little thing prepared, please scan and e mail or submit your accomplished varieties to our claims team. Dealing with paperwork could be tiring, but it’s essential to get your declare assessed. We recommend submitting all the required info directly to keep away from wasting you time. This will stop the necessity to undergo every little thing again and will assist keep away from delays in processing your claim.

Unlike medical insurance, which covers medical bills, earnings protection insurance ensures that you simply continue to obtain a portion of your revenue to cover residing bills, bills, and different financial commitments. This article goals to explain how insurers assess these claims and your proper to make a declare towards income safety

Commercial insurance coverage may also assist business house owners in covering the prices of any accidents their customers could suffer from in an unlucky situation. This cover will also be useful if there’s any property or asset damage that the enterprise experiences as a result of a fireplace, theft, or flooding. If the insurance and funding methods are rushed or ready incorrectly, or if the input of the revenue protection in SMSF members is not thought of, the ATO should hand out penalties. Another drawback is that the payments from the SMSF to you within the occasion of a profitable Income protection SMSF declare may not come instantly.

Income safety insurance may additionally be useful the place what initially seemed to be a short-term harm is later identified as permanent. Income safety is one other form of insurance cover that provides regular funds within the occasion that you’re unable to work as a outcome of illness or damage. Yes, income protection insurance coverage is mostly available via superannuation.